Third Party Insurance Meaning: What It Is & Why It’s Important

Introduction

Insurance can be complex, especially when trying to understand the differences between various policies. One common type that many vehicle owners and businesses come across is third-party insurance. But what exactly does third-party insurance mean? Simply put, it’s a policy designed to protect you in the event of damage or injury caused to another person or their property. Unlike comprehensive insurance, which covers damages to your own vehicle, third-party insurance is focused on ensuring you’re not liable for damage to others.

In this article, we’ll explore the meaning of third-party insurance, how it works, what it covers, and why it’s crucial for drivers and businesses alike.

What is Third-Party Insurance?

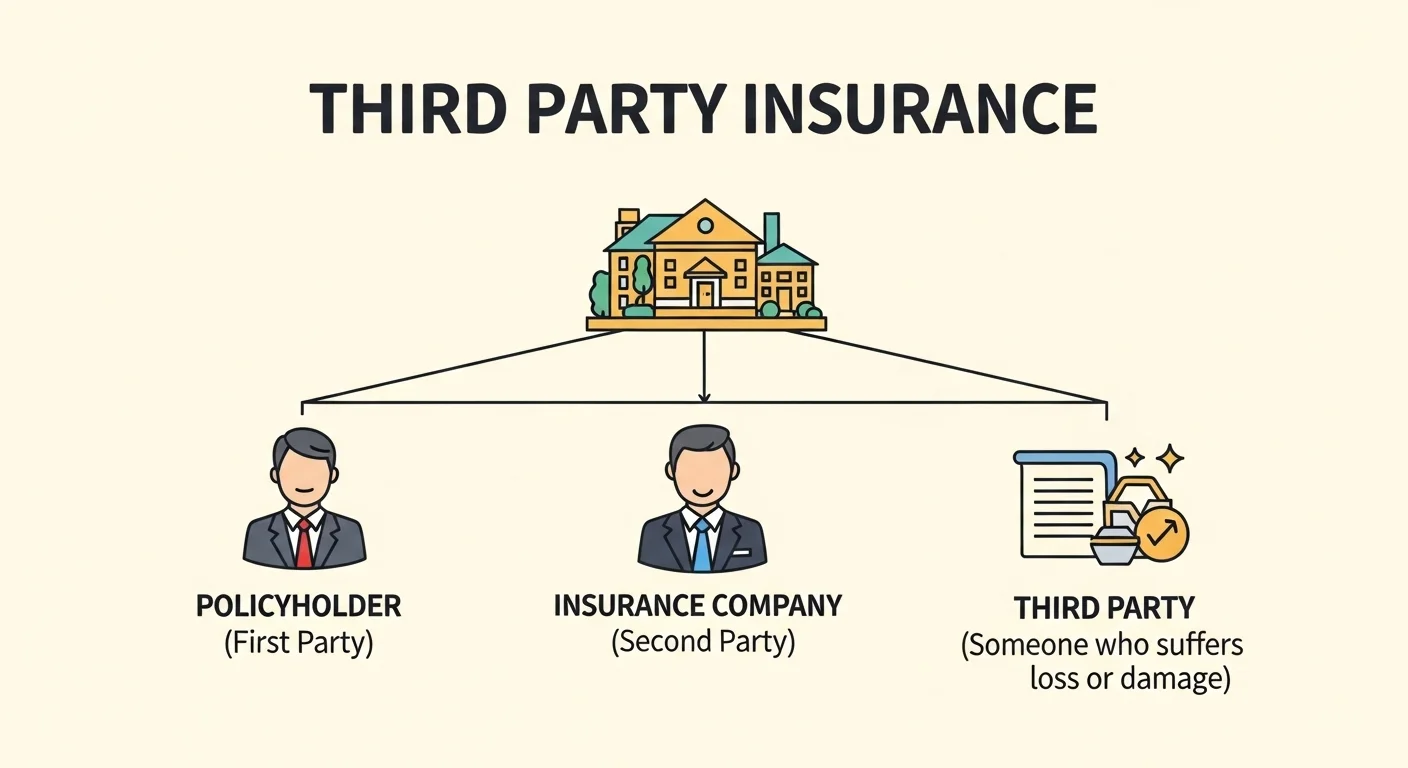

Third-party insurance meaning can be broken down into three main parties involved in the insurance process:

-

First Party: This is you, the policyholder.

-

Second Party: This is the insurance company providing the policy.

-

Third Party: This refers to the other person or entity who suffers a loss (e.g., damage to their car, injuries to a person).

When you have third-party insurance, it covers the third party’s damages or injuries caused by you, but it doesn’t cover your own vehicle or personal injury. This type of insurance is usually a requirement by law in many places, especially for vehicles.

What Does Third-Party Insurance Cover?

Now that we’ve established third-party insurance meaning, it’s essential to understand exactly what it covers. The coverage generally includes:

-

Liability for Property Damage: If you cause damage to someone else’s property, your third-party insurance will cover the repair or replacement costs.

-

Bodily Injury Liability: If you cause an accident that results in injuries to someone else, this insurance will cover medical expenses and other related costs.

-

Legal Costs: If a lawsuit arises due to an accident, third-party insurance can also cover the legal expenses associated with the claim.

However, it’s important to note that third-party insurance does not cover damage to your own vehicle or injuries sustained by you. That’s where other types of insurance, such as comprehensive insurance, come into play.

What Is Not Covered by Third Party Insurance?

While third-party insurance offers great protection for liabilities caused to others, it does have its limitations. Here’s what it does not cover:

-

Damage to Your Own Vehicle: If your vehicle is damaged in an accident that you caused, your insurance will not pay for repairs or replacement.

-

Personal Injury: If you get injured in an accident, your third-party insurance will not cover medical bills or recovery costs. You would need personal injury protection or health insurance for that.

-

Theft or Vandalism: If your vehicle is stolen or vandalized, third-party insurance will not cover those losses.

By understanding these exclusions, you can better evaluate whether third-party insurance alone is sufficient for your needs or if you should consider additional coverage like comprehensive insurance.

Legal Requirements:

In many regions, third-party insurance is not just a good idea — it’s legally required. Governments around the world, particularly in the United States, the UK, and the UAE, mandate that drivers must have insurance before operating a vehicle on public roads. This requirement ensures that if an accident occurs, the responsible party can compensate the injured third party.

For businesses, especially those operating fleets of vehicles or working in high-risk industries like construction, insurance is often necessary to protect against potential liabilities. In many countries, it can be seen as an essential form of risk management, especially when working in environments with a higher likelihood of accidents.

How to Claim Third-Party Insurance

Understanding third-party insurance meaning is just the beginning; knowing how to navigate a claim is just as important. The claims process typically involves the following steps:

-

Report the Incident: Contact your insurance company immediately after an accident. Be sure to provide all relevant details about the incident.

-

Submit Evidence: This could include photos of the damage, police reports, and witness statements.

-

Third Party’s Claim: The third party will usually file a claim with your insurer. Your insurance company will handle this claim and any necessary negotiations.

-

Settlement: If the claim is approved, your insurer will pay the third party directly for the damage or injury caused.

Remember, it’s crucial to avoid making common mistakes during the claims process, such as failing to report an incident promptly or providing inaccurate information.

Third Party Insurance vs. Other Insurance Types

It’s important to understand the differences. The most common comparison is with comprehensive insurance. Here’s how they stack up:

-

Third-Party Insurance: Only covers damage or injury to others. It is typically cheaper and offers a basic level of protection.

-

Comprehensive Insurance: Covers damage to both your vehicle and others, as well as personal injury. It offers broader protection but comes at a higher cost.

Choosing between third-party insurance and comprehensive coverage depends on your needs, budget, and the level of risk you are willing to take.

The Pros and Cons

As with any insurance, third-party insurance comes with its own set of advantages and drawbacks:

Pros:

-

Affordable: It is generally cheaper than comprehensive policies.

-

Meets Legal Requirements: In many areas, it’s a legal requirement to have third-party coverage.

-

Simplicity: It offers basic protection that’s easy to understand.

Cons:

-

Limited Coverage: You won’t be covered for damage to your own vehicle.

-

No Personal Injury Protection: It doesn’t cover your medical bills if you’re hurt.

-

Risk of High Out-of-Pocket Costs: If you need additional coverage, you’ll have to pay separately for it.

How to Choose the Right Third-Party Insurance

When shopping for third-party insurance, consider the following factors to ensure you’re getting the right coverage:

-

Understand Your Needs: Are you driving a new or old car? Do you need additional coverage for personal injury or theft?

-

Shop Around: Compare quotes from different insurers to find the best rates.

-

Check the Policy Details: Ensure the policy meets local legal requirements and provides the level of coverage you need.

By considering these factors, you can find the best third-party insurance policy that suits your personal or business needs.

Conclusion

In conclusion, third-party insurance meaning revolves around protecting yourself and others in the event of an accident. While it doesn’t cover your own vehicle or personal injuries, it provides vital protection against liability claims. Understanding what third-party insurance Meaning covers, the legal requirements, and how to file a claim ensures you are well-prepared. Whether you’re an individual or a business, third-party insurance can help you manage risks and keep you compliant with the law.

Remember to consider your specific needs and compare options before purchasing any insurance policy.

Post Comment