Legal Malpractice Insurance Cost Guide

Introduction

For attorneys, building a career is not just about practicing law, winning cases, or gaining clients. It is also about protecting your reputation and financial future. Legal malpractice claims can be devastating, both emotionally and financially, which is why malpractice insurance is a necessity for lawyers at every stage of their profession. One of the first concerns lawyers have is the cost legal malpractice insurance, as this directly impacts both firm expenses and personal budgeting. Understanding what drives premiums, how costs are calculated, and how to find affordable coverage is essential for making smart financial and professional decisions.

What Is Cost Legal Malpractice Insurance?

Legal malpractice insurance, often referred to as professional liability insurance for lawyers, is designed to protect attorneys against claims of negligence, mistakes, or errors that occur while providing legal services. Unlike general liability insurance, which covers things like accidents on office premises, malpractice insurance focuses on issues directly tied to a lawyer’s professional duty. For example, if a lawyer misses a filing deadline, gives incorrect legal advice, or fails to deliver expected results, a client could sue. Without proper insurance, the lawyer would be personally responsible for defense costs and potential settlements.

This coverage provides peace of mind, allowing lawyers to focus on their cases without constant fear of financial ruin due to unexpected claims.

Average Cost Legal Malpractice Insurance

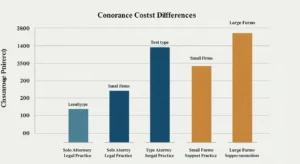

The average cost of legal malpractice insurance can vary widely. Solo practitioners often pay between $500 and $3,000 annually, depending on their practice area and risk exposure. Small law firms with several attorneys may see costs climb into the $3,000 to $7,000 range. Larger firms that handle high-risk cases, such as securities law or medical malpractice defense, may pay upwards of $10,000 per year.

New lawyers generally start at the lower end of the premium scale since their caseload and client base are smaller. Over time, as the firm grows or as lawyers handle riskier cases, premiums typically increase. While most insurers bill annually, some offer monthly payment options to make coverage more manageable.

1. Key Factors That Influence Cost

The cost legal malpractice insurance is not the same for everyone because insurers evaluate several key factors before determining a premium.

-

practice area specialization

One of the most important factors is practice area specialization. Lawyers working in high-risk areas such as personal injury, class action lawsuits, or intellectual property disputes usually pay higher premiums compared to those focusing on estate planning or real estate law.

Geographic location also matters. Attorneys practicing in major cities or states with high litigation rates often face higher costs than those in rural or lower-risk areas.

-

claims history

Another significant factor is the attorney’s claims history. Lawyers with prior malpractice claims or disciplinary issues are considered higher risks, leading to more expensive policies. Firm size also impacts premiums, as insuring multiple lawyers and staff under one policy increases the likelihood of claims.

-

coverage limits and deductibles

Finally, coverage limits and deductibles play a role. Choosing a policy with higher coverage limits provides more protection but also comes with a higher premium, while selecting a higher deductible can reduce annual costs.

2. How to Calculate Your Insurance Premium

Although every insurance company has its own formulas, attorneys can get a good idea of their expected premiums by reviewing their risk profiles. A premium generally starts with a base rate set by the insurer. From there, adjustments are added based on practice area, firm size, claims history, and desired coverage limits.

For example, a solo estate planning attorney with no prior claims in a small town will likely pay far less than a personal injury lawyer in a large metropolitan city. Many insurance providers now offer online calculators or free quotes, making it easier for lawyers to compare costs before committing to a policy.

3. Ways to Lower Your Legal Malpractice Insurance Costs

- While malpractice insurance is an unavoidable expense, there are practical ways to manage it. Implementing strong risk management practices such as using reliable case management systems, documenting all client communication, and performing regular internal reviews can help reduce the likelihood of claims.

- Selecting a higher deductible is another common way to reduce premiums, though lawyers must weigh the savings against the potential out-of-pocket expense if a claim occurs. Some insurers also offer discounts when lawyers bundle malpractice insurance with other coverages, such as general liability or cyber liability insurance.

- Maintaining a clean record is perhaps the best long-term strategy. Attorneys who consistently avoid claims and disciplinary issues often qualify for loyalty discounts and better renewal rates over time.

4. Comparing Legal Malpractice Insurance Providers

Not all insurance companies are the same, and choosing the right provider can make a big difference in both cost and coverage. Some insurers specialize in working with solo practitioners and small firms, while others are better equipped to handle larger law firms with complex risks.

When comparing providers, attorneys should consider more than just the price. Factors such as customer service, claim response times, and the availability of add-on coverages matter just as much. Online reviews and professional recommendations from other lawyers can also help in making an informed decision.

5. Common Mistakes Lawyers Make When Buying Coverage

Many attorneys focus solely on finding the cheapest premium and overlook important details. A common mistake is underestimating coverage needs. While a low-cost policy may seem appealing, it could fall short during a serious claim.

Another mistake is ignoring exclusions in the policy. Some plans may not cover certain practice areas or specific types of claims. Failing to review these details could leave significant gaps in protection. Finally, lawyers often forget to review their policy annually. As practices evolve and caseloads change, coverage should be adjusted to match current risks.

6. Legal Malpractice Insurance vs. Other Liability Coverages

It is important to understand how legal malpractice insurance differs from other types of coverage. General liability insurance covers accidents such as a client slipping in your office, while professional liability insurance focuses on errors or negligence in legal work.

Many attorneys choose to carry both policies to ensure comprehensive protection. This layered approach safeguards against risks that extend beyond the courtroom.

FAQs:

How much should a new lawyer budget?

A new attorney should budget between $500 and $2,500 per year, depending on their location and practice area.

Is malpractice insurance mandatory in all states?

No, only a few states require attorneys to carry malpractice insurance. However, many jurisdictions require lawyers to disclose whether they have coverage, making it essential for credibility.

How often should coverage be reviewed?

Policies should be reviewed annually to ensure they still meet the firm’s needs and reflect any changes in caseload or practice areas.

Conclusion

Understanding the cost legal malpractice insurance is crucial for every lawyer, whether you are just starting out or managing a growing law firm. Costs vary depending on practice area, location, firm size, and coverage choices, but with careful planning, attorneys can secure reliable protection without overspending.

By comparing providers, avoiding common mistakes, and implementing effective risk management strategies, lawyers can strike the right balance between affordability and security. Ultimately, malpractice insurance should not be seen as just another business expense, but as a vital investment in your professional future and peace of mind.

Post Comment