Deed of Trust Real Estate Explained for Buyers and Investors

Introduction

Understanding real estate loan documents is essential for anyone buying, selling, or investing in property. One term that often causes confusion is deed of trust real estate. While it may sound intimidating, it plays a crucial role in property financing in many states. This guide explains the concept in clear language so you can make informed decisions and avoid costly misunderstandings.

What Is a Deed of Trust in Real Estate?

A deed of trust is a legal document used to secure a real estate loan. It places the property into a trust as collateral until the borrower fully repays the loan. Unlike traditional mortgages, this arrangement involves a neutral third party who holds the title on behalf of the lender during the loan term.

The purpose of this document is simple. It protects the lender while allowing the borrower to use and occupy the property. Once the loan is paid in full, the trust arrangement ends, and full title rights return to the borrower.

Why Deeds of Trust Are Used in Real Estate Transactions

Lenders prefer deeds of trust because they offer a faster and more efficient way to recover losses if a borrower defaults. In many states, this process avoids court involvement, which saves time and legal costs.

Borrowers also benefit. Loans secured this way often close faster, and the process can be more streamlined. In competitive housing markets, this efficiency can make a real difference. This structure is especially common in states that allow nonjudicial foreclosure, making it a practical alternative to traditional mortgages.

Parties Involved

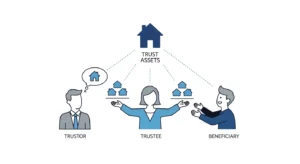

Every deed of trust includes three key participants:

Trustor

The trustor is the borrower. This person takes out the loan and pledges the property as security.

Beneficiary

The beneficiary is the lender. This is usually a bank or financial institution that provides the loan funds.

Trustee

The trustee is an independent third party. Their role is to hold the legal title until the loan is satisfied and to act if foreclosure becomes necessary.

Understanding these roles helps clarify who has which rights during the life of the loan.

Step-by-step working

The process begins when a borrower agrees to the loan terms and signs the promissory note. At closing, the deed of trust is signed and recorded with the local county office.

From there, the borrower makes regular payments while living in or using the property. During this period, the trustee holds the title as security. If payments continue as agreed, nothing changes. Once the loan is fully repaid, the lender instructs the trustee to release the lien. This step formally removes the lender’s interest from the property record.

Deed of Trust Real Estate vs Mortgage

This section is where many readers seek clarity. Both documents secure a loan, but their structure differs. A mortgage involves only two parties and usually requires court approval for foreclosure. A deed of trust involves three parties and often allows nonjudicial foreclosure. This difference can significantly affect timelines and costs.

Because of this efficiency, many lenders prefer this method in qualifying states, while borrowers should understand how it impacts their rights if financial trouble arises.

Deed of Trust vs Promissory Note

These two documents serve different purposes but work together. The promissory note is the borrower’s promise to repay the loan. It outlines repayment terms, interest rate, and loan duration. The deed of trust, on the other hand, secures that promise using the property. Without the promissory note, there is no debt. Without the deed of trust, there is no property security.

Deed of Trust vs Lien

A lien is a legal claim against a property, but it does not always involve ownership transfer. A deed of trust creates a lien while also assigning title to a trustee during the loan term. This distinction matters when selling or refinancing property, as priority and enforcement rights may differ.

What Happens If You Default on a Deed of Trust?

If a borrower misses payments, the lender can instruct the trustee to begin foreclosure proceedings. In nonjudicial foreclosure states, this process follows strict timelines without court involvement. The trustee issues notices, schedules a sale, and sells the property if the default is not cured. Borrowers often have limited time to resolve the issue, which is why understanding this process early is critical.

Advantages and Disadvantages

Advantages

-

Faster foreclosure process for lenders

-

Lower legal costs

-

Efficient loan closing

Disadvantages

-

Less time for borrowers to recover from default

-

State laws vary widely

-

Misunderstanding rights can lead to risk

Balancing these factors helps borrowers decide whether this loan structure suits their situation.

State Specific Rules for Deeds of Trust

Not all states use deeds of trust. Some rely exclusively on mortgages, while others allow both. Laws governing foreclosure timelines, borrower protections, and trustee authority vary by state. Before signing any loan document, borrowers should review local regulations or seek professional advice.

How to Remove or Release a Deed of Trust

Once the loan is paid off, the lender issues a reconveyance request to the trustee. The trustee then records a release document with the county. This step is essential. Without it, the lien may still appear in public records, potentially delaying future property sales.

Common Misunderstandings About Deeds of Trust

Many borrowers believe they lose ownership when signing this document. In reality, they retain equitable ownership and full use of the property.

Another misconception is that selling is impossible. Properties can be sold as long as the loan is paid off at closing. Clarity on these points reduces unnecessary anxiety during transactions.

FAQs

Is a deed of trust legally binding?

Yes. It is a legally enforceable agreement once recorded.

Can you refinance with this type of loan?

Yes, refinancing is possible and common.

Is a deed of trust real estate safer than a mortgage?

Safety depends on borrower awareness, financial stability, and state laws rather than the document itself.

Conclusion

A solid understanding of deed of trust real estate empowers buyers, investors, and property owners to navigate transactions confidently. By knowing how it works, who is involved, and what happens in different scenarios, you can approach real estate financing with clarity and control.

Post Comment